Harnessing mobile network data to forecast the Zaragoza-Santiago air route demand

In recent years, digitalisation has significantly transformed passenger preferences and travel behaviour, resulting in rapid and continuous changes in mobility patterns. For airport operators and airlines it is crucial to stay ahead of these trends and adapt their services swiftly and efficiently. This article presents a case study of Nommon’s WisePax solution, which enables the monitoring of historical demand for long-distance travel between different areas and the prediction of the demand for a new air route between two destinations. The study carried out involved a mobility analysis between the Spanish cities of Zaragoza and Santiago de Compostela before 2022, when no air route existed, and the forecast of the demand captured by such a route if it were implemented. The predictions were then compared with the actual demand for the new air route opened by Ryanair in 2023, showing the ability of WisePax to provide accurate demand forecasts for new air connections.

Briefing

Digitalisation has significantly transformed passenger preferences and travel behaviour, leading to rapid and continuous changes in mobility patterns. Airport operators and airlines need to stay ahead of these trends and adapt their services swiftly and efficiently to remain competitive, enhance passenger satisfaction, and optimise operational performance.

The analysis of air passenger behaviour has traditionally relied on surveys. However, surveys are expensive, time-consuming, and thus limited in both the sample size and the frequency of update, often making them insufficient for capturing the rapid changes in travel behaviour. The increasing digitalisation of the aviation sector has enabled the use of other data sources for this purpose, such as Global Distribution Systems (GDS). GDS data enable the characterisation of passenger demand based on the aggregation of flight or hotel bookings, but lack detailed itinerary information (such as the door-to-door origin and destination of the trips or the rest of transport modes used in multimodal trips). In recent years, anonymised mobile network data has opened the door to the collection of vast amounts of mobility data with a level of detail that other methodologies cannot achieve, making it possible to overcome some of the main limitations of traditional passenger surveys and GDS data.

At Nommon we are experts in the use of anonymised mobile network data and other geolocation data to obtain mobility and presence indicators. Over the past ten years, we have conducted extensive research to explore how this information can be leveraged to study travel behaviour through projects such as BigData4ATM, TRANSIT, IMHOTEP, and TravelInt. These projects have led to the development of WisePax, a passenger intelligence platform designed to support airports in the optimal management of passenger flows.

The case study presented in this article, developed as part of the TravelInt project, demonstrates the benefits that WisePax brings to airlines and airport operators by analysing the 2022 travel demand between the catchment areas of two Spanish airports, Zaragoza and Santiago de Compostela, and forecasting the demand for a new air route connecting these airports, which did not exist in 2022 but was later introduced by Ryanair in March 2023.

Solution

Thanks to the use of anonymised mobile network data and its fusion with a variety of other sources, WisePax enables a comprehensive monitoring of historical long-distance travel demand, a complete analysis of the door-to-door journey, and a detailed passenger characterisation:

- Long-distance demand: WisePax enhances the information typically available to airlines and airport operators, which often rely on air travel demand data from their own systems, open data portals, or GDS providers. This data focuses solely on air travel and lacks visibility into other modes of transport. WisePax overcomes this limitation by providing a comprehensive view of long-distance demand across all major transportation modes, including road, rail, air, and ferry. This multi-modal approach ensures a more accurate representation of demand between an origin-destination (OD) pair, enabling airlines and airport operators to better understand overall travel dynamics.

- Door-to-door journey analysis: the solution can track passengers’ complete door-to-door journeys. This feature enables the precise identification of both the actual origin and destination, rather than just the airport location, providing a full picture of the passenger’s travel itinerary. WisePax also enables the detection of multimodal trips. For instance, it can identify whether, after completing an air leg, passengers use another mode of transport or take another flight to reach their final destination.

- Passenger characterisation: WisePax also provides detailed passenger profiling, which includes aspects such as age, gender, place of residence, income, etc. This deeper understanding of the passenger characteristics, preferences, and behaviour entails valuable insights for airlines and airport operators, allowing them to tailor their services more effectively.

WisePax does not only focus on analysing historical passengers behaviour, but also uses this data to calibrate predictive models able to accurately forecast future travel demand. These predictive capabilities enable airlines and airport operators to anticipate the demand for new air routes or services.

For this case study, we selected the Zaragoza and Santiago de Compostela airports. Zaragoza is one of Spain’s largest cities, with a population of over 670,000 in 2022 (INE), while Santiago de Compostela is the primary airport for the Galicia region, handling more than three million passengers in 2022 and serving as a gateway for the entire region. The distance between both cities—approximately 650 km—combined with the inefficient ground transport network connecting them, made these airports an appealing option for the establishment of a new air route.

The analysis was structured in two parts. The first part involved a historical analysis of 2022 demand between the catchment areas of the Zaragoza and Santiago de Compostela airports using WisePax’s descriptive module, which offered valuable insights regarding the potential attractiveness of the new route. In the second part of the study, WisePax’s predictive module was used to forecast the demand captured by a new air route connecting Zaragoza and Santiago de Compostela. This route was opened one year later by Ryanair, enabling a comparative analysis between the demand levels forecasted by WisePax and the actual demand captured by the new Ryanair route.

“To efficiently adapt services and air routes to the constant changes in passenger behaviour, it is essential to have accurate data that enables a clear understanding of these shifts. Mobile phone data has become a fundamental source in this regard, offering an excellent opportunity to gather high-quality information on passenger mobility and profiles. The application of advanced analytics to this data makes it possible to estimate the potential demand for a prospective air route, providing airport operators, local stakeholders, and airlines with the ability to make informed, data-driven decisions.”

José Antonio Hernández Espinosa

Aena Data Management Division

Outcomes

Analysis of historical demand between Zaragoza and Santiago de Compostela

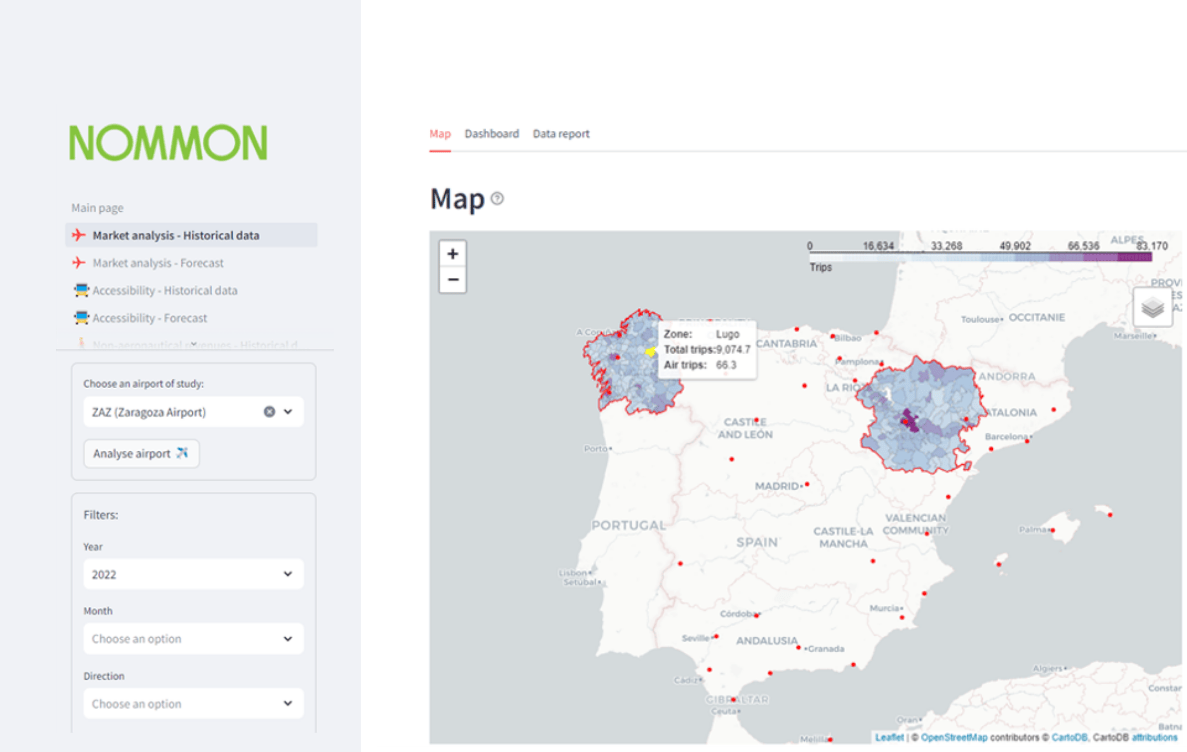

The analysis of the historical travel demand between the catchment areas of Zaragoza and Santiago airports revealed a total of 233,912 passengers during 2022. Figure 1 presents how the demand was distributed across the main cities in both regions, Zaragoza, Santiago, Vigo, A Coruña, and Lugo. More than one third of the trips had their origin or their destination in the municipality of Zaragoza.

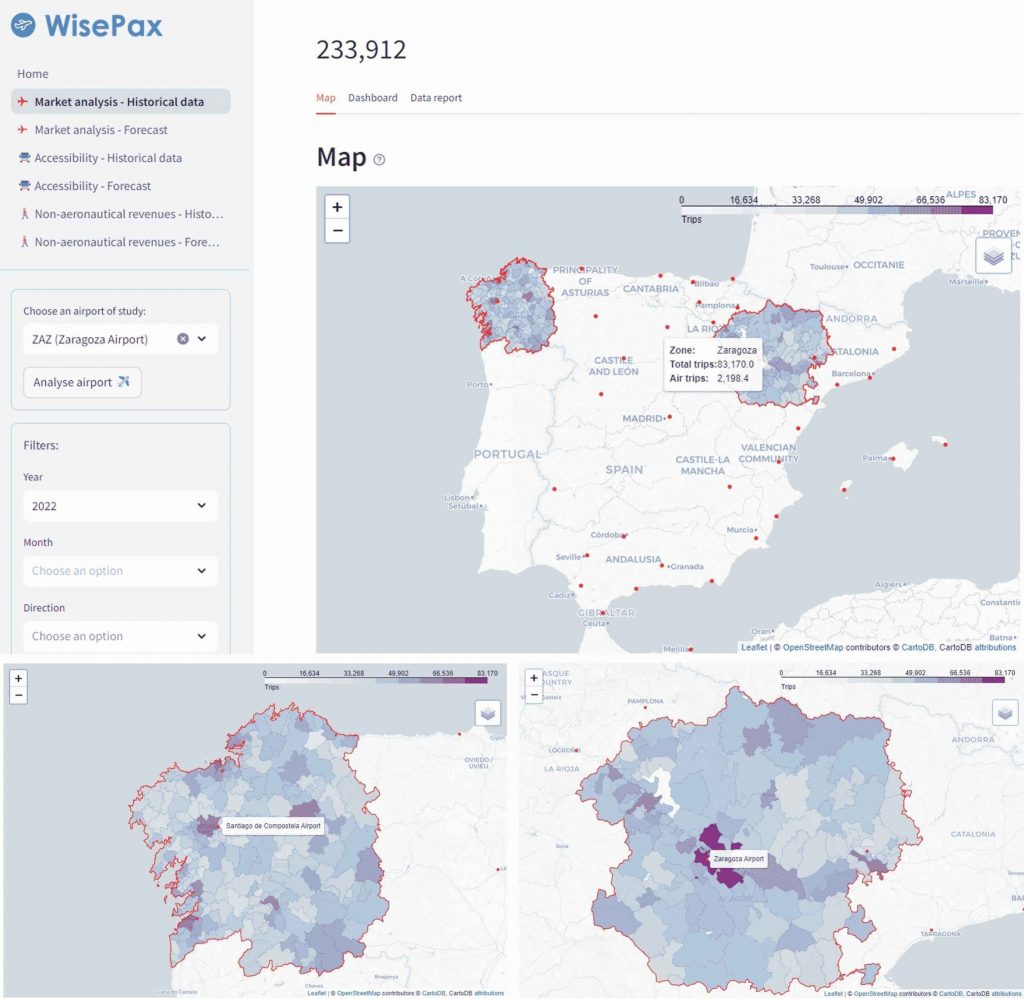

Figure 2 illustrates the modal share between the catchment areas of Zaragoza and Santiago de Compostela. As shown, most of the demand consists of road trips, which account for 81.8% of the total number of passengers, while rail and air represent 14.8% and 3.4%, respectively. The low share of rail transport can be attributed to the ineffective connection between the two regions, with direct rail journeys taking around 10-11 hours, and high-speed rail options, involving connections in Madrid, requiring approximately 7-8 hours.

Regarding air travel, all trips involved a combination of air and other modes, as no direct routes were in place during the period of study. The most demanded routes were Barcelona-Santiago and Madrid-Santiago, with a total demand of 2,900 and 1,430 passengers, respectively, followed by other less frequent routes between Madrid and Barcelona and other airports in Galicia (A Coruña and Vigo). A smaller proportion of passengers used alternative routes, such as Bilbao-Santiago and Valencia-Santiago, possibly chosen by passengers starting their journeys in areas close to the Basque Country and the Valencian Region, respectively, as Zaragoza’s catchment area encompasses zones near to these two regions.

In terms of mode combinations, the majority of air passengers (78.7%) combined air travel with road transport, while 21.3% used a combination of air and rail. WisePax also provides valuable insights into passenger behaviours depending on their profiles. For instance, the data reveals a difference in modal share between national and foreign passengers (see Figure 2): while both of them predominantly opted for road transport, national passengers are more prone to using rail than foreign passengers.

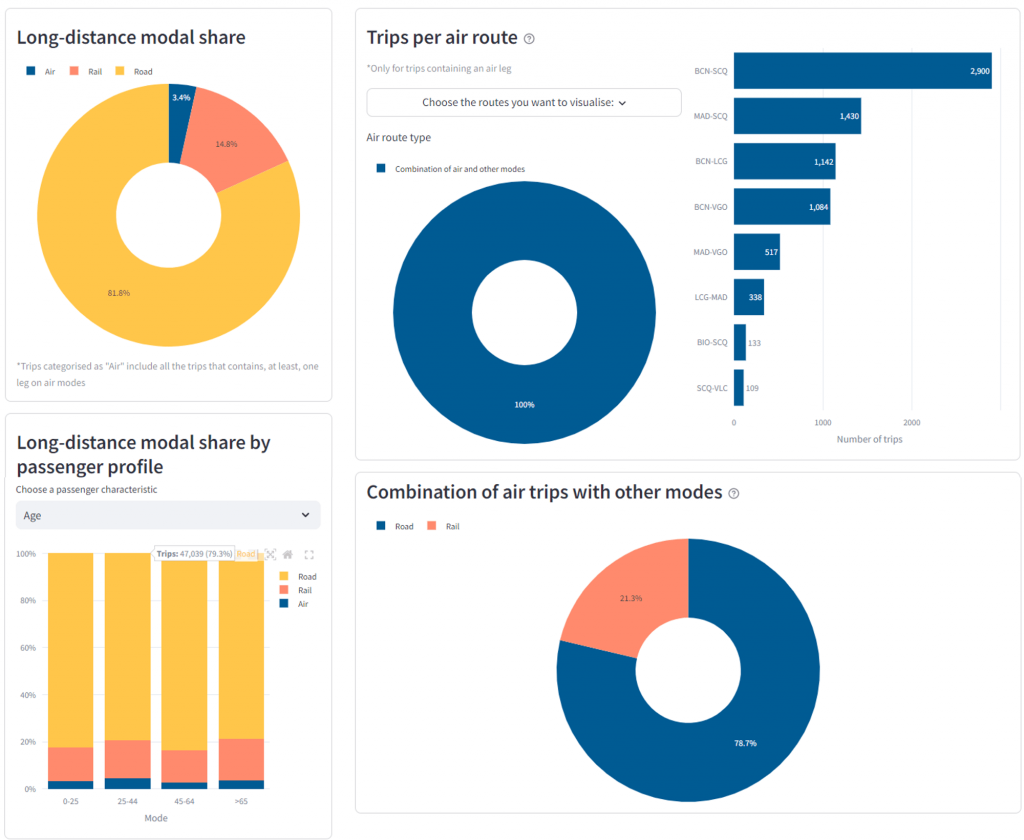

In terms of passenger profiling, Figure 3 shows that most of the travellers between both regions are from Spain, with only 5% being foreign passengers, mainly from Portugal and France, likely due to the proximity of these countries to the airports’ catchment areas. Regarding the place of residence of national travellers, most are from the province of Zaragoza (59.387 passengers), while a significant number come from La Coruña (40,304), Pontevedra (30,550), and Lugo (14,527). This suggests that demand is relatively balanced in both directions, with passengers travelling from Santiago’s catchment area to Zaragoza and vice versa. This is useful information for airlines and airports when considering how to market the route. WisePax also provided insights into other sociodemographic factors, such as age, gender, and income, as well as on trip frequency, allowing a deeper understanding of passenger behaviour and preferences.

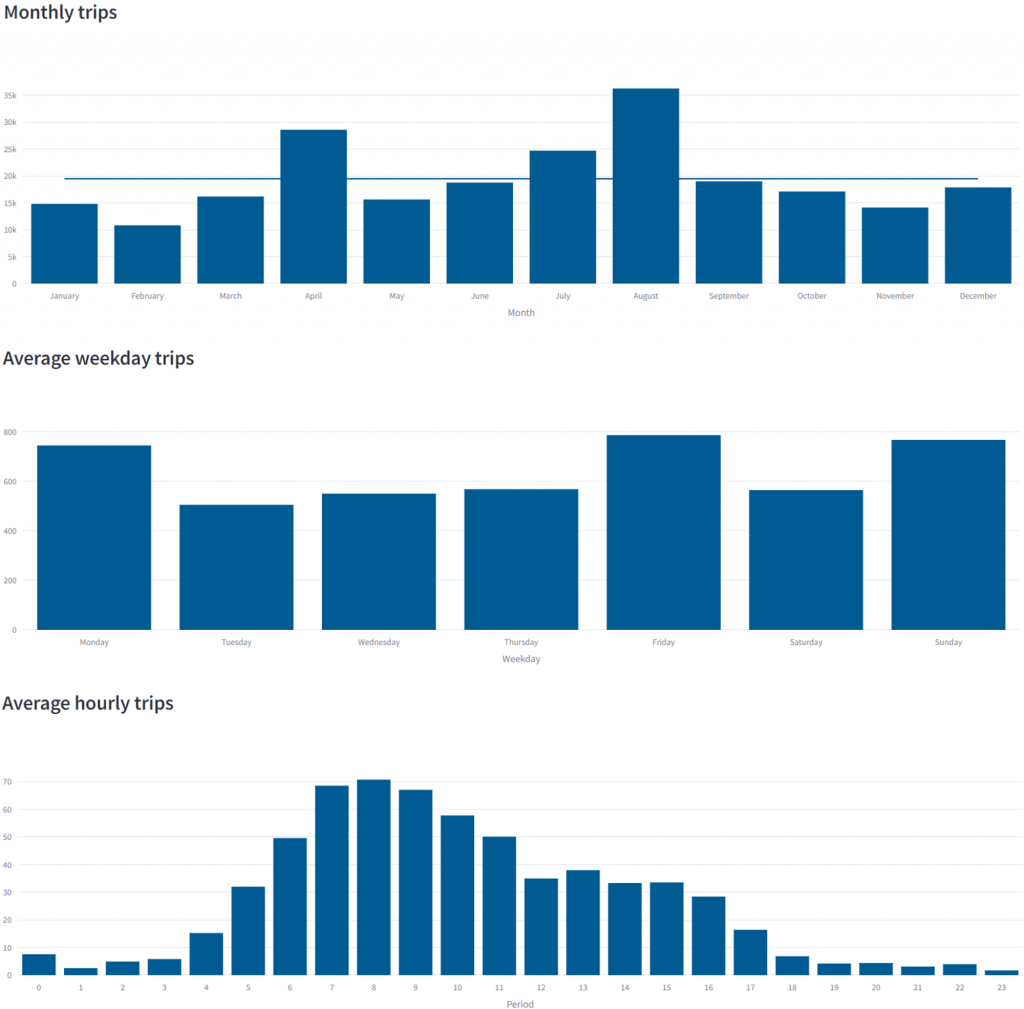

Finally, WisePax offered valuable insights into the longitudinal behaviour of demand during the study period, as shown in Figure 4. The data reveals the distribution of trips across different months, with the highest passenger volumes recorded in August (36,249), April (28,586), and July (24,708), corresponding to the summer period and Easter holidays. Significant demand was also observed in September (19,006), June (18,770), and December (17,871), while February (10,829) and November (14,138) had the lowest demand.

In terms of weekly travel patterns, most trips took place on Fridays and Sundays, with an average of 787 and 767 trips per day, respectively, followed closely by Mondays with 745 trips. The analysis of hourly travel patterns reveals a peak between 7-9 a.m., after which the number of trips steadily decreases throughout the day. This trend may be explained by the long travel times between the two regions, encouraging passengers to begin their journeys early in the morning.

Forecasting demand for a new air route between Zaragoza and Santiago de Compostela

WisePax’s predictive module was used to forecast the demand captured by a new air route between Zaragoza and Santiago de Compostela airports. The objective of this exercise was to estimate the potential demand that the new route could capture. Therefore, for this case, no supply limitation or flight schedules were considered, assuming that all passengers forecasted to travel by air will be able to do so. Airlines can use this information to define specific operational details (for example, days of operation, flight schedules, etc.) in a way that optimises the captured demand.

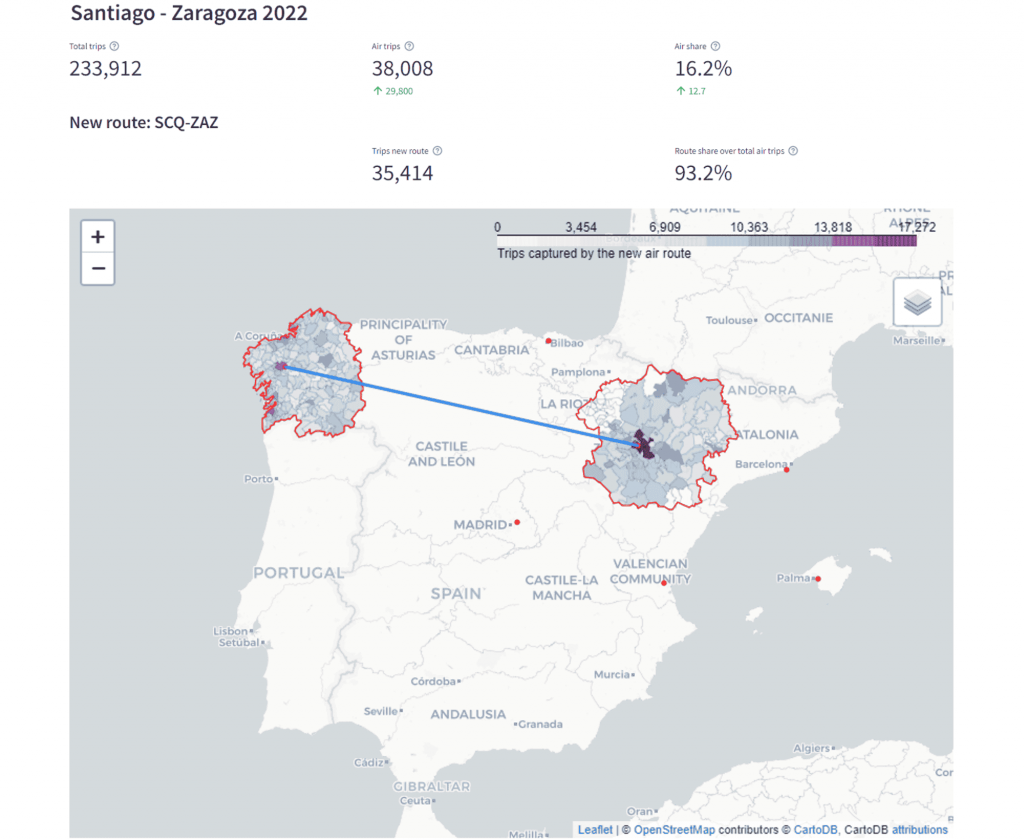

The forecast, presented in Figure 5, indicates that the new route could capture 35,414 passengers. This brings the total air passenger demand between the two regions to 38,008 passengers (16.2% of the share), with the new route accounting for 93.2% of the total air passenger share.

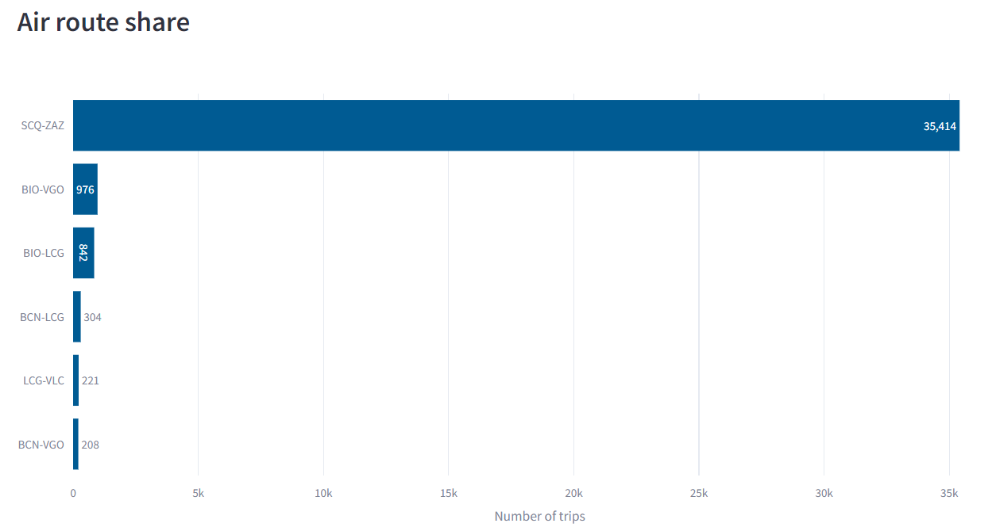

Additionally, the map highlights how the demand of this new route is distributed, showing that the new route does not attract any trips from areas close to Bilbao and Valencia airports. This observation aligns with the information presented in Figure 6, which illustrates the distribution of passenger demand across different air routes. While the new route captures the majority of demand, a small number of passengers continue to travel from nearby airports (Bilbao, Valencia, or Barcelona) to other airports within Galicia (Vigo and A Coruña). These passengers start or end their journeys in regions near Bilbao and Valencia, travelling to or from regions closer to Vigo or A Coruña, and thus do not use the new route.

Figure 7 presents a comparison between the current modal share and the forecasted modal share after the introduction of the new route, along with information about which modes this demand has been captured from. The data shows that most of the trips are captured from road transport (24,073), with smaller proportions coming from rail (5,727) and existing air routes (5,614). This is significant as it indicates that the new air route is capturing most trips from non-aerial modes, thus minimally cannibalising other already existing air routes.

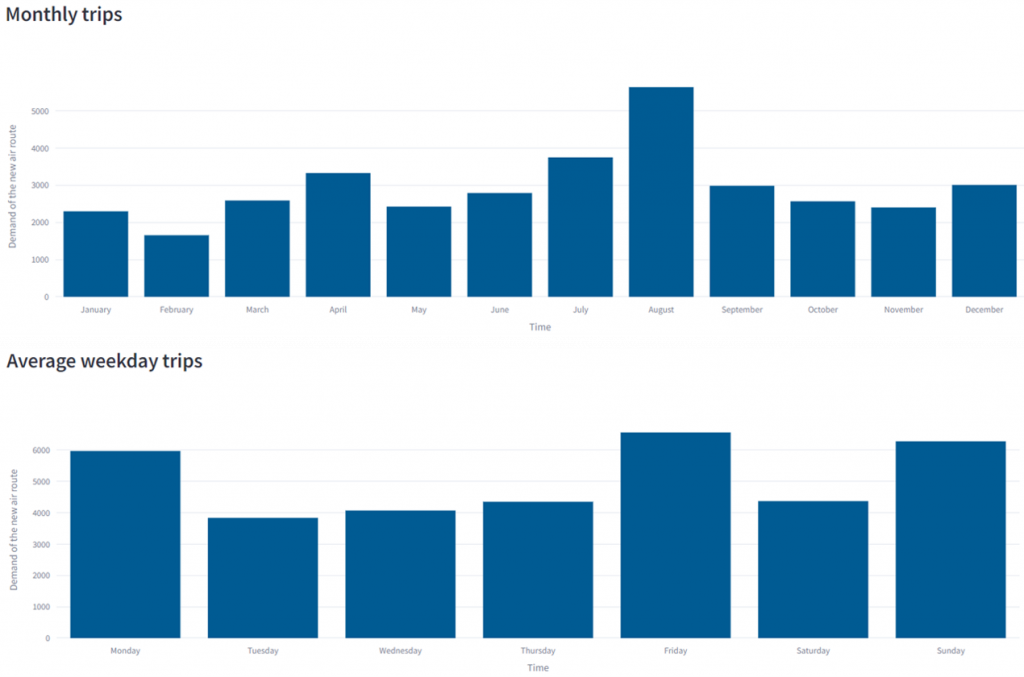

Lastly, Figure 8 presents the monthly distribution of trips captured by the new route, as well as the average demand per weekday. Most trips are captured in August, with April and July also showing high demand levels. This information is relevant for airport operators and airlines when determining the optimal operational period for the route. Regarding the day of the week, Fridays, Sundays, and Mondays account for the highest number of trips, offering useful insights for scheduling the service.

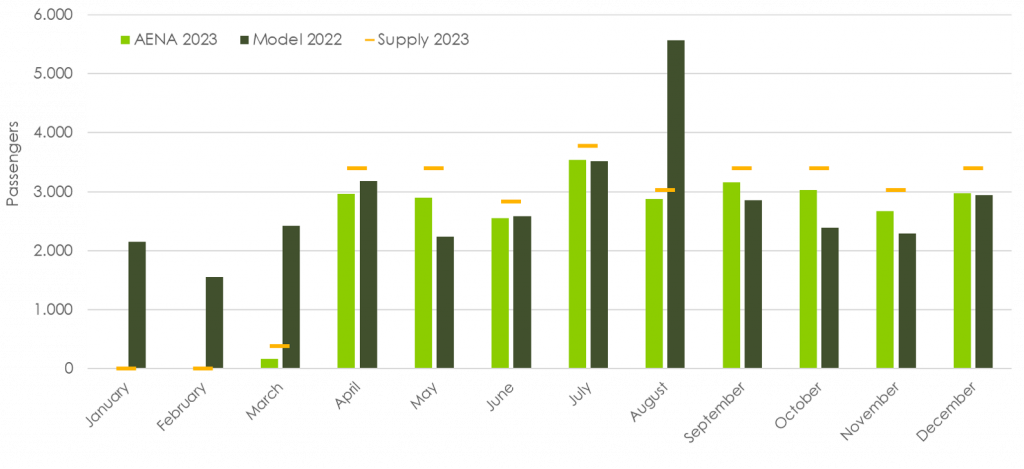

In March 2023, Ryanair opened the Zaragoza-Santiago route with two weekly flights in each direction. According to the data published by Aena, 26,806 passengers used this route during 2023, while the model’s predictions for the same period forecasted a total demand of 27,554. Figure 9 provides a monthly comparison, showing that, from April onwards, the forecasted demand accurately aligns with the actual demand. The higher deviation occurs in August, which may be attributed to the limited flight supply (represented by yellow lines), which was not able to serve all the potential demand. The average occupation levels for August reached 95%, suggesting that higher supply could have led to higher captured demand.

What we learnt

As any other service, air transport is being impacted by the rapid changes in passenger behaviour driven by widespread digitalisation. Airports and airlines must be able to identify these shifts and seamlessly adapt their services to meet evolving passenger needs. Mobile network data provides an opportunity to gather high-quality mobility information with a level of detail impossible to achieve with traditional methods, delivering a comprehensive understanding of door-to-door travel demand. WisePax leverages the opportunities offered by this new data source by providing a tool that allows the users to monitor long-distance demand across all modes of transport, while providing detailed passenger characterisation.

The Zaragoza-Santiago air route case study demonstrated how WisePax facilitates the monitoring of long-distance travel demand and the forecast of the demand captured by new air routes, empowering airport operators and airlines to make informed route development decisions.